When inflation strains our finances, watch out for people spreading exclusion and division for profit.

Canadian families are grappling with the significant impact of inflation, which has notably diminished the purchasing power of both renters and homeowners. The Consumer Price Index (CPI), a crucial indicator of living costs, has surged by 14.3% from June 2020 to June 2023, illustrating the steep rise in prices across various sectors. Statistics Canada’s website outlines the factors driving this increase, including escalated food, fuel, and housing costs.

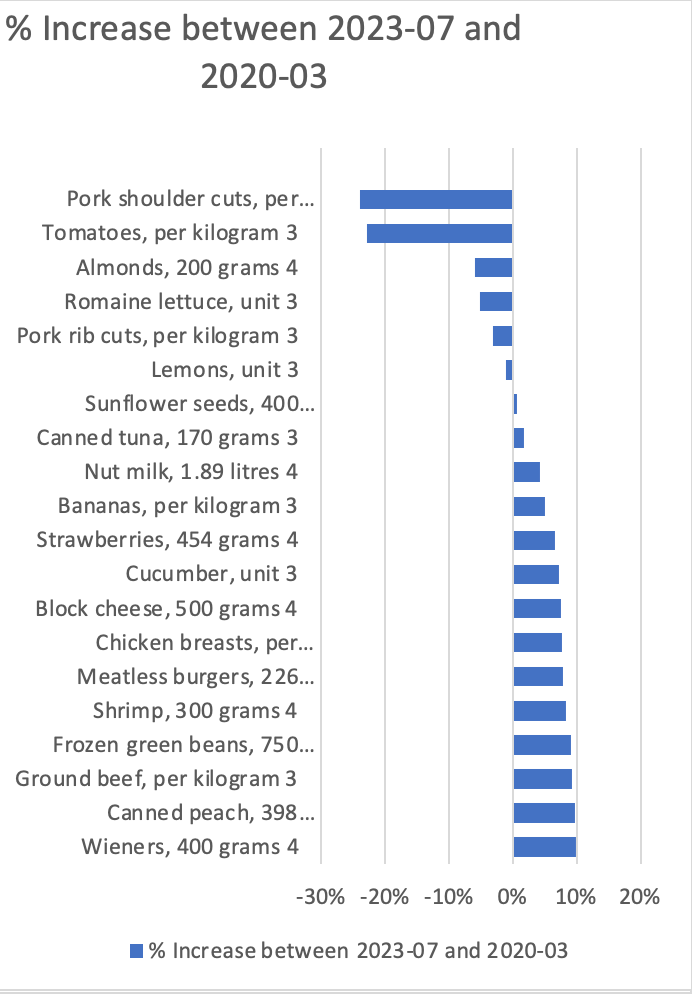

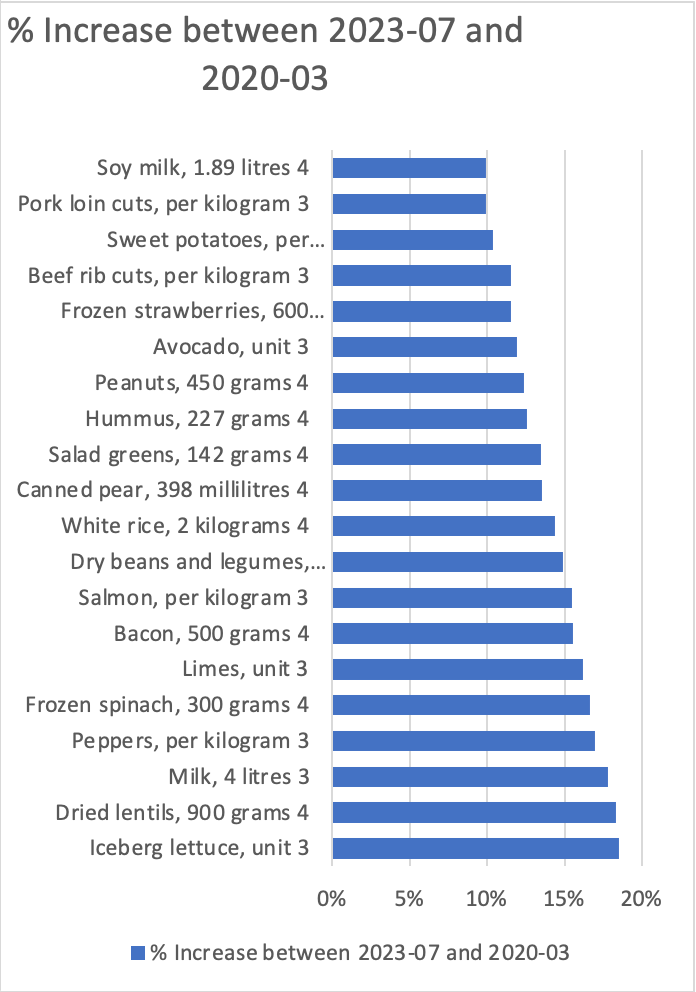

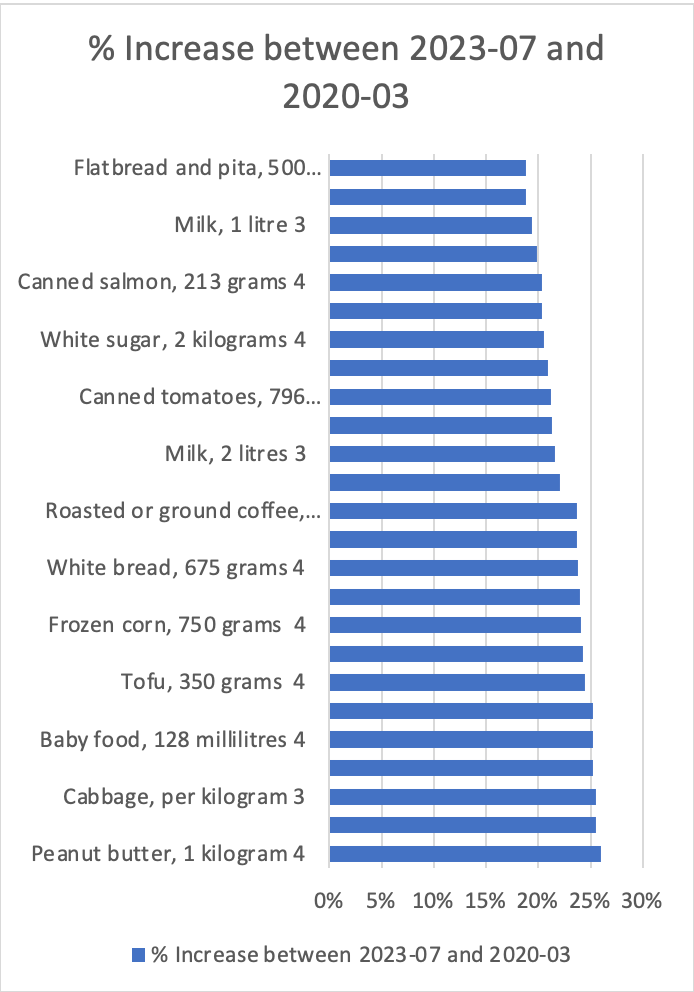

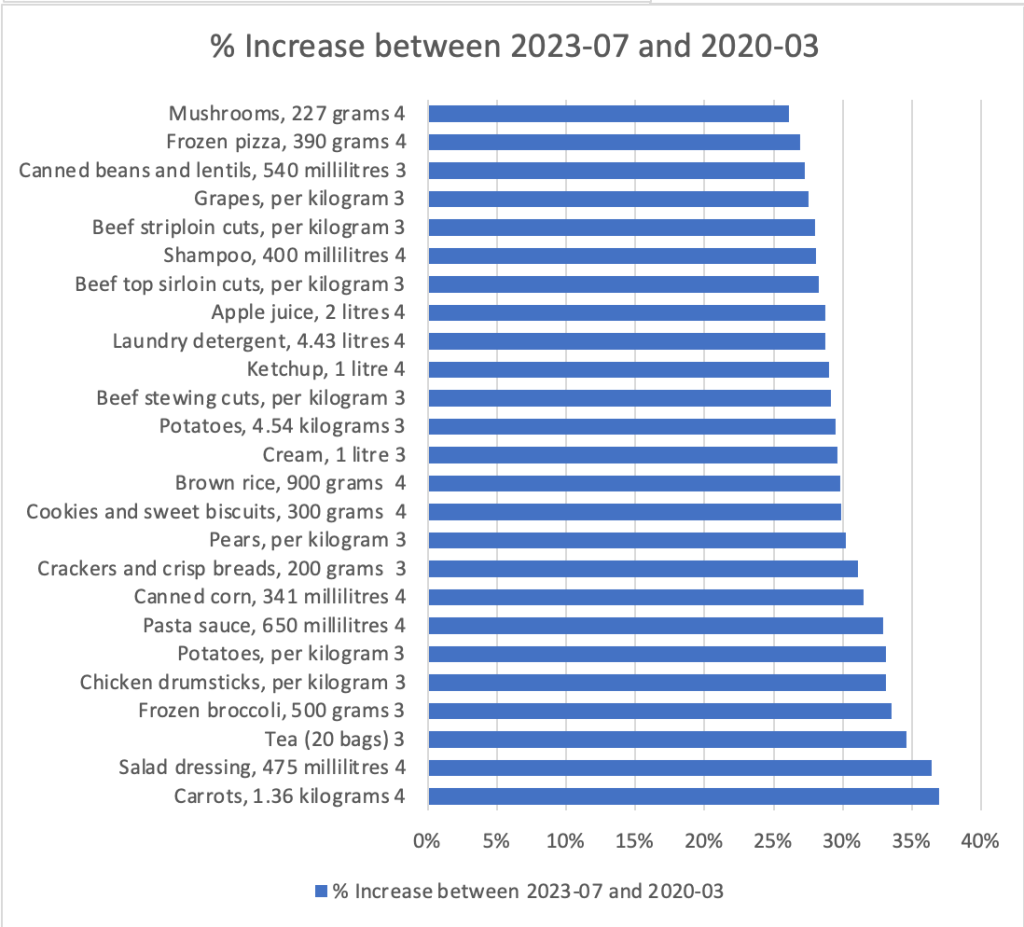

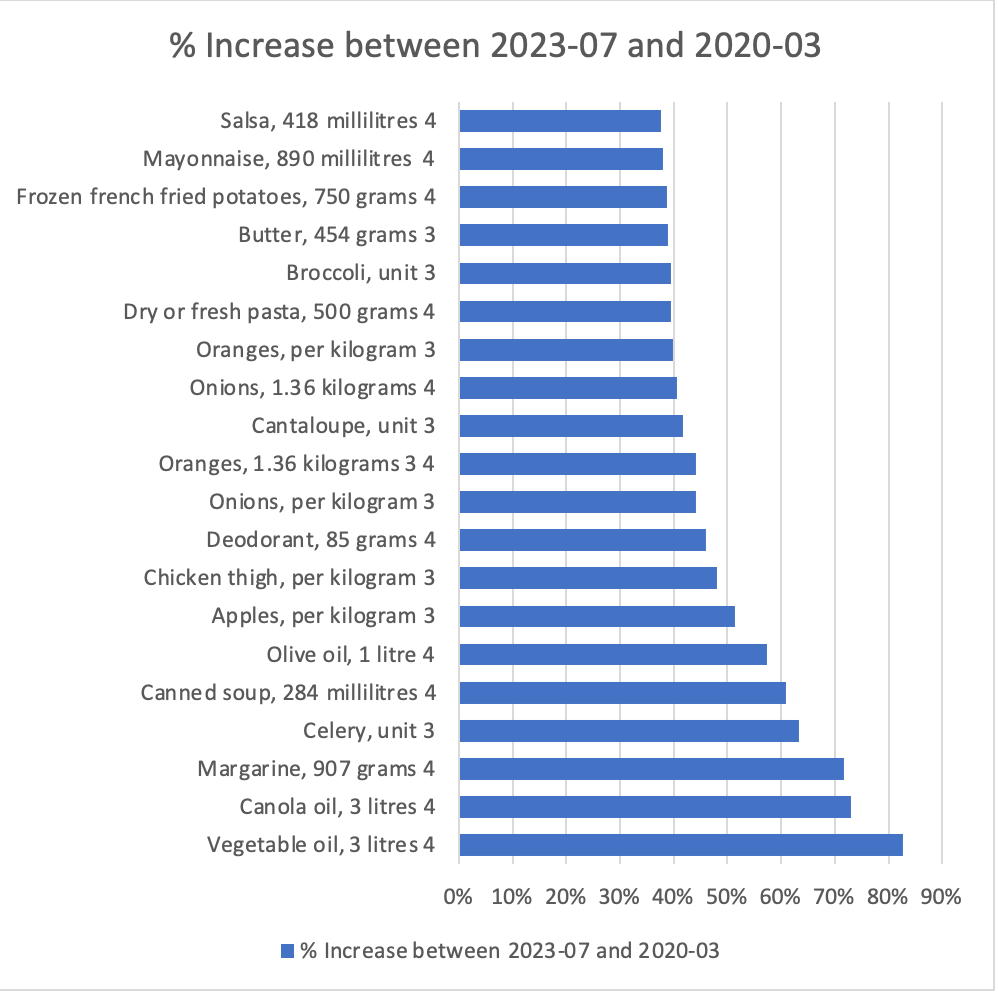

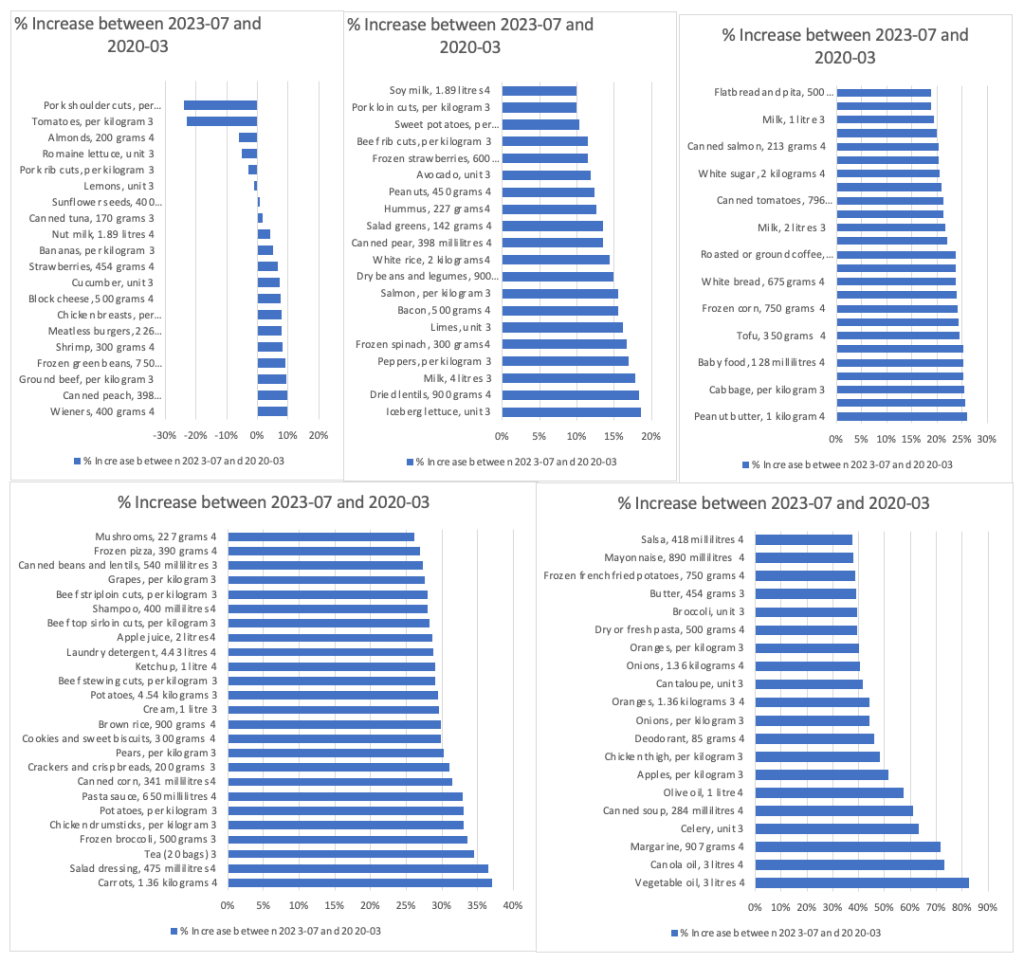

In British Columbia, Vancouver and Victoria have seen respective average index increments of 5.6% and 5.5% over the last year alone. A detailed report by the Province reveals that in July 2023, the regional CPI was 3.0% higher than the previous year’s. Several categories witnessed notable price hikes, with food at 6.6% and health and personal care at 6.1%. However, some sectors experienced decreased prices, including transportation, clothing & footwear. Nevertheless, there were significant upticks in the cost of specific food items, such as bakery products and non-alcoholic beverages. The next update from Statistics Canada will be September 19, 2023.

Slide show data source: Statistics Canada.Table 18-10-0245-01 Monthly average retail prices for selected products in British Columbia

When I look at my finances, times are more challenging than five years ago. Based on CPI, my purchasing power has dropped 15% since I became a full-time employee at my current workplace in October 2019. This drop is despite receiving annual salary increases that fall within expected increases in the sector that employs me. This erosion of financial stability is not just a personal narrative but a nationwide concern.

Experts weigh in on the current inflation trend, pointing to various influencing factors. Jean-Paul Lam, a distinguished economics professor and former Bank of Canada assistant chief economist, mentioned in a 2022 CBC interview that government spending, although a contributing factor, isn’t the dominant force behind the inflation surge. He emphasized the significant role of other global influences, such as fluctuating oil prices and the real estate boom witnessed globally, not just in Canada.

Adding to this narrative, University of Calgary economics professor Trevor Tombe highlighted the limited impact of government fiscal policies on current inflation rates. He suggested that larger, uncontrollable global forces are at play, affecting oil and real estate prices predominantly. Meanwhile, NDP Leader Jagmeet Singh attributed the soaring living costs to the opportunistic pricing strategies of large corporations, a viewpoint partly echoed by Lam. The pandemic has facilitated big business growth at the expense of smaller entities, contributing to increased prices when families across the country were already reeling from the disruptions caused by the lockdown and the nationwide economic slowdown it contributed to.

In a related development, a July 2023 Globe and Mail article that reported an apparent boom in Canadian entrepreneurship during the pandemic fueled by aspirations of business ownership among 55% of Canadians, according to a 2021 Royal Bank of Canada poll, tells us the surge fizzled out later. According to the article, despite early promising signs of economic recovery and potential growth avenues, the reality fell short. Many business ventures only progressed beyond initial aspirations or small-scale side hustles.

The article accentuated the necessity of fostering entrepreneurship to bolster economic growth and innovation, especially given Canada’s predicted lag in GDP per capita growth over the next decade, as per the Organisation for Economic Co-operation and Development. The challenge now lies in nurturing these entrepreneurial seeds into flourishing ventures that can contribute to reversing the current bleak economic projections.

In light of the present economic environment, my financial narrative is not isolated but resonates with families across Canada, perhaps echoing louder in the households of those relying on fixed incomes. As I navigate through this period of escalating costs, balancing between meeting essential needs and curtailing expenses, the weight of diminished purchasing power hangs heavily on my family’s shoulders – a sentiment I know is shared universally at this moment. I’ve had to cut back on discretionary expenses, am thinking about how much I need to own a vehicle, and just recently pulled back about the largess of my insurance plans so I can make ends meet. It’s not a comfortable feeling.

Reflecting upon this, it is becoming increasingly clear that the economic landscape we once knew is transforming, possibly steering us towards a pivotal junction where we might have to reimagine our approaches to financial stability and growth. The stakes are undeniably high, and the struggle is real and palpable in every transaction that takes a little more out of our pockets than before. I see the fear in the discourse online and in the media, and it’s no wonder populist extreme-right undercurrents are growing in popularity in our Country and abroad. History has shown time and time again that turmoil and economic pain encourage saviours ready to blame vulnerable “others” to spring up, ready to distract us from the grim reality of economic downturns.

Yet, amidst this financial turmoil, we must foster a spirit of resilience and innovation. Much like budding entrepreneurs who harbour dreams of carving out their niche in the business world despite the odds, we must adapt and evolve. It calls for a collective effort to safeguard our present and build a future where economic downturns do not dictate the quality of our lives.

As a community, we find ourselves at a juncture where our actions today will shape tomorrow’s financial landscape. We could remain passive spectators, but I prefer that we become more proactive agents of change, channelling the entrepreneurial spirit that is burgeoning in many Canadians.

As I introspect on my family’s journey, it serves as a microcosm of the larger narrative unfolding in Canada. We are witnessing an unprecedented shift in economic dynamics, where the old paradigms are being questioned and new ones are yet to be forged. More and more families rent, and more and more of us live in urban regions. Nearly three in four Canadians (73.7%) lived in one of Canada’s large urban centres in 2021, up from 73.2% five years earlier. Downtowns are growing more rapidly than before. From 2016 to 2021, the downtown populations of the large urban centres grew faster (+10.9%) than the urban centres as a whole (+6.1%). 16% of us work from home, and more and more young workers need to be more employed.

Canada has a large influx of newcomers, bringing new demand for products and services, skills, and ways of working. Young workers increasingly work multiple jobs in the gig economy as employment opportunities lasting longer than two years seem increasingly infrequent.

But in uncertainty, there is also an opportunity. Canadians have a chance to redefine our financial narratives to build an inclusive and prosperous future where no family has to bear the brunt of inflated costs alone.

We will get through these turbulent waters together as a society and do a better job if we hold one another up than if we pick on people like us like some politicians are already trying to do. Canadians are innovative and resilient, and we will do what we have always done: innovate ourselves back into regained financial stability without leaving people behind. Instead, we will continue to build an equitable Canada. We just need to ensure we do not turn on one another and not let extremists poison our waters. Let’s seize this moment as an opportunity to innovate, collaborate, and build a robust economic future that is resilient to the ebbs and flows of global trends, and that tide will lift all our boats.

Leave a comment